[ad_1]

Quick Facts About Car Prices

- In August 2023, average new car transactions were about 25% higher than the same month three years ago when no end was in sight for the pandemic.

- However, average transaction prices are flat compared with last year. Electric car prices are down about 18% from a year ago.

- Manufacturer incentives averaged $2,365 in August.

- You can easily find a new Chrysler, Dodge, Ram, or Lincoln, though not necessarily a Honda, Kia, Toyota, or Lexus.

In the last several years, car shoppers have grown accustomed to paying more than the manufacturer’s suggested retail price (MSRP). They watched car prices steadily rise, with no end in sight. It left many shoppers scratching their heads, and the question our experts get most is, “When will new car prices drop?”

We can tell you that new vehicle price inflation has almost disappeared this year. That’s great news on its face. However, car prices have increased exponentially in the last three years. Now, the United Auto Workers strike threatens inventory and prices again.

In this story, we’ll explain how to navigate car buying so that if you’re in the market to purchase a vehicle, you’ll be equipped with the best information from our experts. We dig deeper to answer concerns about car prices dropping.

What Drives New Car Prices?

According to Kelley Blue Book data, new car average transaction prices (ATP) stayed flat month-over-month in August at $48,451. Compared with last year, transaction prices are up just $42.

Transaction prices dropped 2.4%, or $1,212, compared to the start of the year. Our research experts say that’s the largest decrease in the past decade.

RELATED: Auto Workers On Strike – What It Means for Car Shoppers

“After a tumultuous last few years in the automotive marketplace, now we are seeing new-vehicle pricing trends hold steady,” said Rebecca Rydzewski, research manager at Cox Automotive, the parent company to Kelley Blue Book. “Dealers and automakers are feeling price pressure, and with high auto loan rates and growing inventory levels, new-vehicle prices seem to have hit a ceiling, at least for now.”

Ford, Stellantis, and GM bulked up inventory prior to the UAW strike. Rydzewski said, “With the current inventory levels in place, we don’t expect a short-lived strike to impact consumer prices in any meaningful way, at least in the near term.”

Manufacturer incentives increased to an average of $2,365 in August, the highest level in a year. More on that in a bit.

Average transaction prices remain about 25% higher than in August 2020 as the realities of the COVID-19 pandemic set in. At that time, average transaction prices for new vehicles were $38,635.

Vehicle Pricing Breakdown

- Non-Luxury vehicle prices: In August, car buyers paid an average transaction price of $44,827. Overall, prices have held steady since January.

- Luxury vehicle prices: The average transaction price was $64,107 for luxury vehicles. Luxury vehicles make up about 19% of total vehicle sales. Since January, luxury prices dropped by more than 4%.

- Electric vehicle prices: The average transaction for a new electric car is $53,469, down about 19% from a year ago. Tesla’s average transaction prices have dropped 19.5% compared to August 2022. In particular, Tesla Model 3 prices are down more than 21% year over year. According to the Cox Automotive Dealers Sentiment Index published recently, franchised automobile dealers voiced declining expectations for EV sales in the coming months.

“Dealers are realizing this is not going to be an easy road in the short term, especially for some brands,” said Cox Automotive Chief Economist Jonathan Smoke. “However, the pressure dealers feel is from over-supply rather than a lack of demand. This is a natural speed bump and an expected part of growth. The No. 1 issue for consumers is price, and that’s a barrier even to considering an electric vehicle. As an economist, I can confidently predict that surplus inventory and increased competition will eventually drive down prices, which will help with EV consideration and adoption.”

These factors typically affect new car prices:

- Inventory availability

- Manufacturer incentives

- Dealer discounts

- Trade-in vehicle value

All four of those factors experienced major disruptions in the past several years.

New Car Inventory Update

During the height of the pandemic, inventory fell to record lows, primarily driven by a worldwide microchip shortage. Without enough crucial microchips, which control everything from engine timing to navigation systems, automakers couldn’t build cars as fast as they wanted. Despite near-normal car inventory, the chip shortage continues to linger for some carmakers and certain models.

Kia said in a recent conference call, “The average number of contracts per day is increasing, but backorders are also increasing due to a lack of production.”

Last year, manufacturers like Ford began rethinking inventories for the long haul, even with the resolving chip shortage.

Dealerships measure their stocks of new cars to sell in a measurement called “days of inventory” — how long it would take them to sell out of new vehicles at today’s sales pace if the automaker stopped building new ones. Last year, inventories fell to just one week. By the end of August, many brands’ inventories were up 68% from a year ago. However, a few carmakers can’t fill car orders due to a lack of inventory.

Ahead of the United Auto Workers strike, domestic brands began adding excess vehicles to inventory.

Which Automakers Have the Most Vehicles?

Cox Automotive’s analysis of its vAuto new and used car dealership management software data shows that brands like Chrysler, Dodge, Ram, Lincoln, Jeep, Buick, Infiniti, and Ford offer plenty of new vehicle stock. In contrast, inventory levels still sit well under normal for Honda, Kia, Toyota, Lexus, Subaru, Cadillac, Hyundai, and Chevy.

RELATED: Is Now the Time to Buy, Sell, or Trade-in a Car?

Overall, inventory continues to improve. The auto industry stocked 58 days’ worth of vehicles at the end of August. It’s close to what’s considered a normal supply of inventory, or 60 days’ worth by historical standards. In the summer of 2019 (during pre-pandemic times), automakers stocked about an 86-day supply of vehicles.

Still, the lower the price category, the tighter the supply. New cars under $20,000 are the toughest to find, with a 21-day supply of vehicles to sell.

Vehicle Incentives Are Back

Carmakers used more incentives to attract buyers in August than at any point this year. According to Kelley Blue Book’s analysts, carmakers spent 4.9% of the average transaction price on incentives meant to move vehicles. Incentives averaged about $2,365. The average incentive spending was 2.3% of average transaction prices a year ago.

When automakers build up an oversupply of cars, they discount the vehicles to get them off dealer lots. For the past several years, carmakers and dealerships showed no glut of cars to sell, and they barely discounted. Now, supply is building up again, partly because of higher interest rates on car loans.

According to our analysis, the high-end luxury car segment offered the highest incentives in August at 10.1% of average transaction prices, followed by electric vehicles at 8.1%. Shoppers could find entry-level luxury cars with incentives of 7.3% and full-size pickup trucks at 6.1%. Vans, high-performance cars, and small and midsize pickup trucks had some of the lowest incentives in August.

Shop Around for the Best Offer on Your Trade-In

Trade-in value is another factor driving car prices. A lack of used vehicle stock began pushing prices higher, giving stock to the idea that buying a new vehicle is cheaper than purchasing a newer model used one. But we’re talking about trade-ins here, and it’s a great time to trade in your vehicle. Automakers scaled back production for several years after the 2008 recession. That leaves the higher-mileage, older cars dealers sell for less than $20,000 particularly hard to find now.

Dealers value your trade-in partly based on what they need in stock. They’re more likely to offer a good deal to buyers on a car fewer people are looking for currently. Car dealers are oversupplied with relatively expensive used cars.

In other words, consumers trading in a 2018 Honda Civic will be much happier with the trade appraisal than those trading in a 2021 Jeep Grand Cherokee.

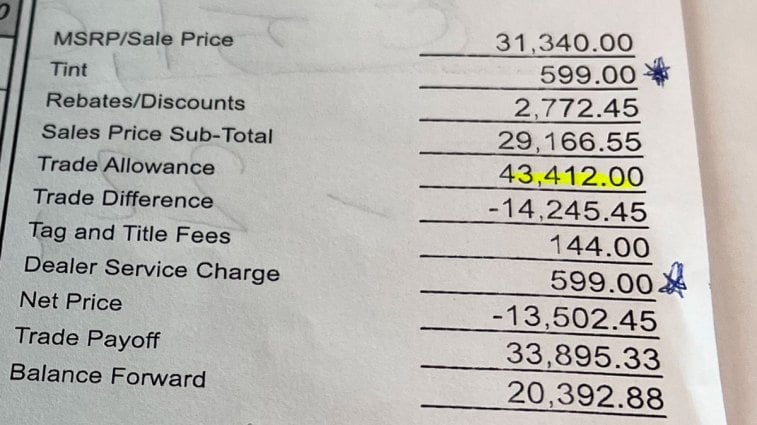

Shoppers should also be prepared to shop their trade-in around. It’s slightly more complicated to pull off, but selling your old car to one dealership may make sense, and buying your new car from a different one if the final invoice numbers work out better. Use the Kelley Blue Book Instant Cash Offer tool to shop your trade-in vehicle at nearby dealerships. When you let the deals come to you, you can select the best trade-in offer for your situation.

PRO TIP: I recently used the Instant Cash Offer tool to see what I could get for a family vehicle as I was sitting in a dealership trying to seal a deal for a subcompact SUV. The ICO offers started flowing in as high as $50,000 for our 2021 Ford F-150 Lariat with a hybrid powertrain with low miles of 13,000 and no accident history. At the dealership where I was attempting to make the deal, they offered $43,412. With a Kelley Blue Book value of $50,196, I tried to use the other offers as leverage, but the dealership wouldn’t budge. So, I walked away from the dealership with the low-ball offer and went to another with the best offer.

New Car Prices Started Dropping

So, when will new car prices go way down? For some brands and some dealerships, prices began dropping. With other brands, like Honda, Kia, and Toyota, shoppers must be prepared to hunt and pay more for tougher-to-find models.

In recent months, hard-to-find cars and SUVs include the Toyota Highlander, Honda CR-V, Toyota Camry, Toyota Corolla, Honda Civic, and Toyota RAV4.

Meanwhile, truck manufacturers stocked up on pickups ahead of the UAW strike.

Last April, investment banking firm UBS said in a research note that the global automotive sector might see overproduction, even as supply chain issues ease. The research said, “Production will likely exceed sales by 6%, driving inventories significantly higher, even above pre-pandemic levels.” So, while supply chain issues have mostly been resolved, the researchers said there’s a “high risk of overproduction and growing pricing pressure as a result.”

Some Vehicles Still Sell at Markup Prices

While some carmakers and dealers with plenty of inventory provide incentives, others are still in short supply. It means some dealerships are still marking up some vehicles.

According to Markups.org, some Toyota, Kia, and Hyundai models appear to be selling above MSRP in places like California, Tennessee, and Texas.

PRO TIP: Since shopping recently for a vehicle, I found markups varied at dealerships that sold vehicles such as Kia and Hyundai. One dealer charged $599, and another $699. Another called them “doc fees.” Before you shop, understand how much those document filing fees cost for car tax, tag, and title in your state before you buy a vehicle. Those are pure markups or profit centers for the dealership. Another markup on an invoice may say “paint and fabric protection” or “window tint.” Before you sign anything, it’s wise to ask the salesperson to remove those fees if they really want to sell you the car.

What to Expect: Looking Ahead

But what if you desperately want a popular car that’s in low supply? Then you may need to be patient. Recent Federal Reserve interest rate hikes to rein in inflation make big-ticket purchases harder for shoppers. Even as vehicle supply reached near-normal levels, other interest rate hikes could be coming. Those trends may help bring down the prices of even the most popular cars.

But experts can’t pinpoint when that will happen. Instead, car shoppers should remain flexible.

Also impacting the automotive space is the UAW strike against America’s Big Three automakers, GM, Stellantis, and Ford. With furloughs, idled plants, and more, it’s anyone’s guess when any agreement may come.

Still, finding a low price on a new car is possible. It just may not be the car you thought you would buy. Or you may need to head to a smaller town outside the big city where there’s less competition.

Editor’s Note: This article has been updated for accuracy since it was originally published.

Related Articles for Car Buying:

[ad_2]